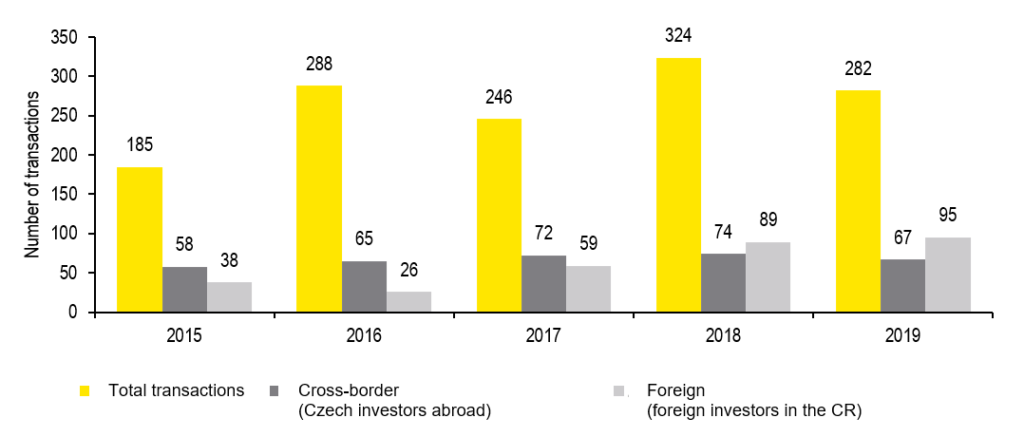

A total of 282 concluded transactions testifies to the significant interest of domestic and foreign investors. The year 2018 was a record year in terms of the number of transactions in the Czech Republic; last year, we saw a slight decrease of 13%. The market is dominated by real estate sales transactions and transactions in the technology sector. The EY M&A Barometer analyzes the current situation and key trends on the Czech M&A market in 2019.

Source: EY

“Expectations of continued high transaction activity were confirmed last year. Despite a slight year-on-year decline, we view events in the area of mergers and acquisitions very positively. The key favorable factor supporting the high degree of activity on the Czech mergers and acquisitions market in 2019 was the continuing positive development of the macroeconomic situation. That all changed with the advent of the global pandemic of COVID-19, which virtually stopped the world economy from March 2020. The impact on the M&A market for at least the near future will be significant,” says Štěpán Flieger, M&A Department Director at EY in the Czech Republic.

Since 2016, we can again see a growing trend in the inflow of investors from abroad in terms of the number of individual transactions. At 34%, the ratio of acquisitions made by foreign investors to the total number of transactions reached the highest value ever in 2019. The most active foreign investors in 2019 were Germans with a total of 17 completed transactions, followed by Americans and Austrians.

Domestic transactions continued to account for the highest share in the total number of transactions. It is interesting that the ratio of inbound and outbound investment this year significantly exceeded the number of domestic transactions in the period under review.

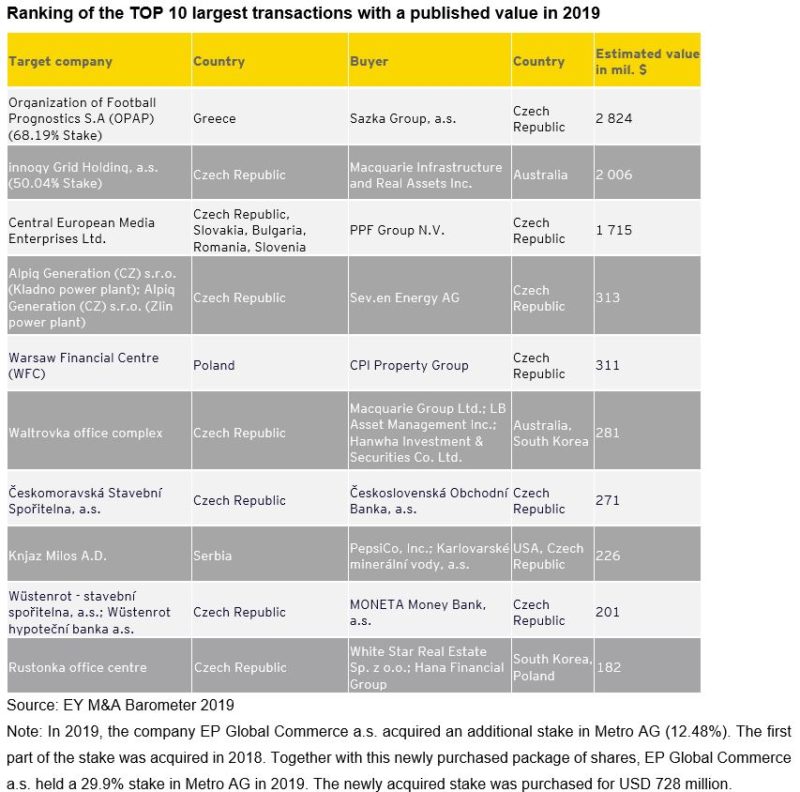

Of the ten largest transactions concluded this year, three fall into the category of domestic transactions, two involve foreign investors and four were Czech investors investing abroad. The last category includes the largest transaction – the acquisition by Sazka Group a.s. of a 68.19% stake in the Greek company OPAP.

Despite the overall decline in the number of transactions compared to last year, it is clear that the appetite of financial investor increased in 2019. They accounted for one third of the total number of transactions, meaning the number of transactions concluded by them increased by more than 20% compared year on year.

However, investors that had a strategic plan and the participation of Czech billionaires (and their financial groups) predominate in the ten largest transactions.

The most active investor in 2019 was the CPI Group with seven transactions, followed by the ČEZ Group with six deals. The IT group Solitea with five transactions and EPH with four were also active.

Compared to the previous year, the first two positions in the order of the number of concluded transactions within individual sectors remained unchanged. Real estate transactions and acquisitions of technology companies still hold the first two spots. However, there was a change in the relative representation of both sectors in the total number of transactions. Although there was a decrease of about 5% (25 transactions, in absolute terms) in real estate transactions, three transactions from this sector were included in the TOP10 selection for 2019. Korean investors played a role in two of these three transactions.

For technology companies, on the other hand, we recorded an additional 8 successfully completed transactions. In this sector, we can mention a significant transaction, where the majority stake in Kiwi.com was sold for approximately USD 130 million to the buyer General Atlantic.

Sectors such as manufacturing, consumer goods and energy have traditionally been at the M&A forefront, with two of the long-term most active players in the M&A market – ČEZ and EPH – playing an important role. The other two largest transactions of 2019 are in the energy sector. For more than USD 2 billion, a consortium led by Macquarie Infrastructure and Real Assets, which includes British Columbia Investment Management Corporation and Allianz Capital Partners, bought the remaining stake (50.04%) and became a 100% owner of innogy Grid Holding a.s. The second significant transaction was the acquisition of a 100% stake in Alpiq Generation CZ by Sev.en Energy owned by Pavel Tykač. The value of this transaction was approximately USD 313 million.

On the other hand, in the media and entertainment sector there was a decline in activity by roughly half. Nonetheless, several interesting transactions took place in the Czech Republic in this sector. The largest is the acquisition of Central European Media Enterprises, which includes Czech television station Nova, owned by the PPF Group. This transaction, incorporating companies from the Czech Republic, Slovakia, Bulgaria, Romania and Slovenia, has not yet been completed.

The second transaction is the sale of Warhorse Studio, developer of the highly successful game Kingdom Come, to the Swedish gaming company THQ Nordic, which made the purchase through its Austrian subsidiary Koch Media. The last transaction to mention in this sector is the sale of Beat Games to the American company Oculus VR, a subsidiary of Facebook.

In banking, sector consolidation continued last year. While the number of transactions developed almost identically to the previous year, two were included in the list of the ten largest. The first was the acquisition of Českomoravská stavební spořitelna, which now belongs to ČSOB. In the second transaction, MONETA Money Bank acquired Wüstenrot – stavební spořitelna and Wüstenrot hypoteční banka.

As regards other sectors, we saw a more significant increase in the pharmaceutical and biotechnology sectors. Here we would mention the transaction in which the German company STADA Arzneimittel bought the Czech company Walmark.

An historical evaluation of M&A activity would be incomplete without reflecting the current situation. According to the latest EY Global Capital Confidence Barometer survey (conducted on a group of more than 2,900 members of top management), plans for divestments or acquisitions in the next 12 months are at a historical high – 56% of respondents expect their company to be active in M&A in this time horizon. When choosing a target company, investors intend to focus on its economic resilience (38%), and are expecting company prices to fall (39%); however, the expected price decline is not the only motive for buying companies.

“It’s clear that the previous crisis following 2008 was a lesson and the corporate world will much more proactively monitor the M&A situation and actively participate in such transactions. At least that’s how the current survey result can be interpreted,” says Petr Kováč, Partner EY Transactions Advisory Services, adding “Developments after the last financial crisis have shown that this is the time when quality acquisitions can be made advantageously. We learned from the downturn in the M&A market between 2008 and 2012, because now, in retrospect, we see that it was an opportunity to acquire quality businesses that would help entire groups grow faster in a vibrant market.”