--UPDATED 6 April 2020 -- The Czech Ministry of Labour & Social Affairs has published a manual on how to submit your application for the Antivirus programme.

We have prepared a document in English, leading you through this application step by step (pdf download will start automatically).

If you prefer the Czech manual, please find it here (pdf).

The Ministry of Labour and Social Affairs has also prepared a video guide to fill out the first part of the application (in Czech). The second video still has to be published so we refer to our pdf manual for the second part of the application process.

-- Update to our "Kurzarbeit" article posted on 27 March --

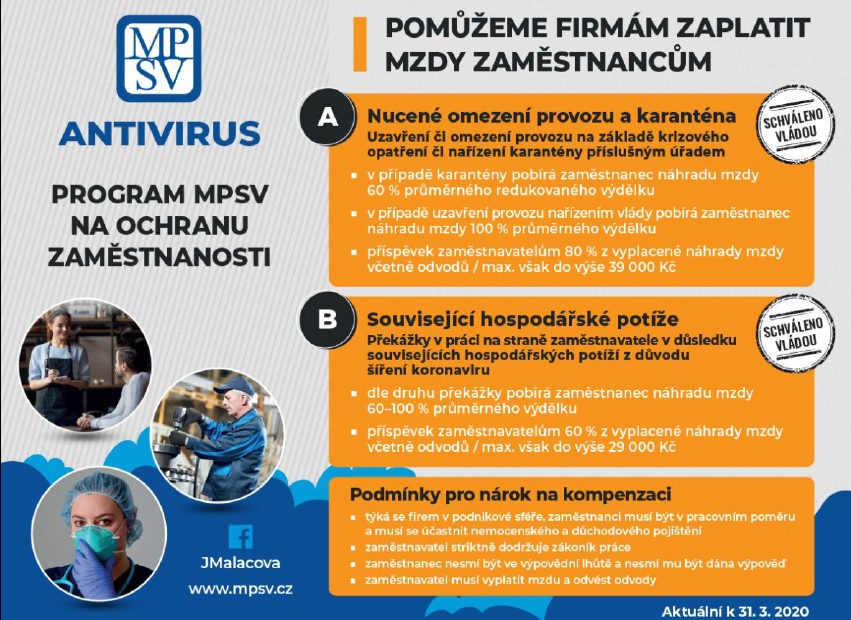

On Tuesday, March 31, 2020, the government approved a proposal to modify the Antivirus programme. The Antivirus employment protection programme is designed to help businesses protect their jobs. The state will use the Labour Office of the Czech Republic to compensate companies for costs incurred. This measure will help employers to manage the current situation better and avoid layoffs.

To whom and under what conditions will the compensation be due?

Employers whose economic activity will be at risk due to the spread of the coronovirus will be granted a financial contribution, in whole or in part, for wage compensation due to an obstacle on the part of the employee (quarantine) or due to an obstacle on the part of the employer (forced closure of the company). The obstacle to work must be because of the COVID-19 outbreak.

The programme will only apply to employers whose labour costs are not covered by public budgets and, the impact on the costs incurred by employers from 12 March 2020 for the duration of the obstacle to work, but no later than the end of April 2020 (with the possibility of extending the programme until the end of May 2020). Applications can be submitted from 6 April 2020.

To qualify for the compensation, you will need to meet the following conditions:

Employment agencies have the possibility to apply for contribution for employees whose employment contract was agreed before 12 March 2020 and lasts for the entire duration of the programme.

Who will pay the contribution and how long?

The contribution will be paid by the Labour Office of the Czech Republic; the amount and duration of the provision will depend on the reason of the obstacle at work.

What concrete measures will be implemented and what situations do they respond to?

The amount of compensation paid to employers is derived from the average super-gross wage, including mandatory contributions (CZK 48,400). Its amount will depend on the reasons why employees were kept from working. Employers will be able to apply to the Labour Office for a contribution in two regimes:

Regime A (includes former A and B): In the case of ordered quarantine of employees, the contribution amounts to 80% of eligible expenses (wage/salary compensation + social and health insurance), up to a maximum of CZK 39,000 per month per employee for the duration of the following obstacles to work. Conditions:

Regime B (includes form C to E): A contribution amounting to 60% of eligible expenses, but no more than CZK 29,000 per month per employee. The link between the obstacle to working with COVID-19 is being presumed. Conditions/situations:

When should the employer apply for compensation?

The Antivirus programme will start from April 6, 2020. From then on, applications will be possible. We assume that there will be a delay of only a few days between the submission of an application and the payment of contributions by the Labor Office.

How to apply?

The exact terms and procedures will be posted on the MoLSA website later this week. We expect five steps:

Information will be available on the website of the MoLSA and the Labour Office. The site also features a chatbot that will be programmed to answer programme-related queries.

When should the employer apply for compensation?

Detailed information on the use of the programme, including the application, will be published later this week. The current situation is that applications can be submitted starting 6 April 2020.