The latest EY survey of directors of hundreds of domestic companies across industries showed that almost half of companies (44%) will not have to halt production by the end of this year. The previous period of growth was used by 60% of companies to save more than two months of financial reserves for the event of a loss of income. Every second company (52%) expects, at most, a 25% sales drop. Business executives now have a chance to make the most of the crisis and show what trends will prevail once the pandemic subsides.

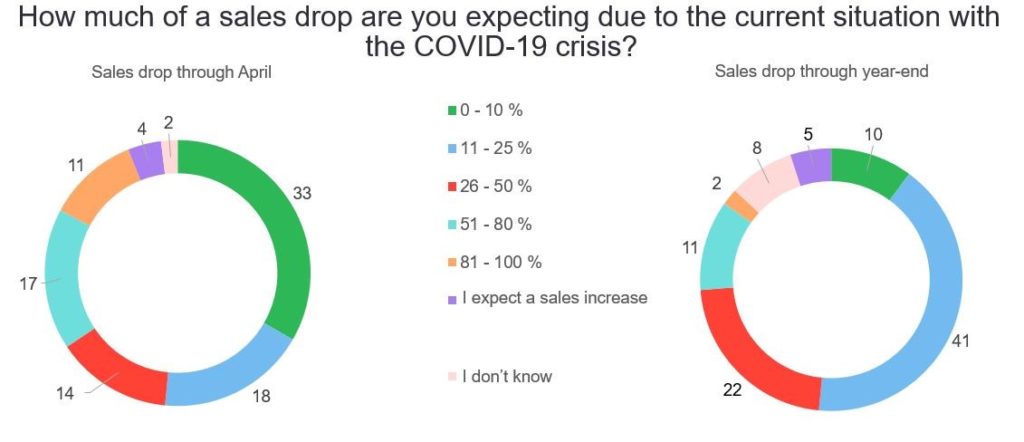

The global crisis caused by the COVID-19 pandemic is having a significant impact on the Czech economy. Almost all domestic entrepreneurs (94%) who participated in the survey have already experienced a drop in sales in April. By the end of the year, 87% of respondents expect it. Only 5% of companies are anticipating grow. Companies in the manufacturing and information and communication services sectors are less affected by the crisis.

Almost a third of entrepreneurs (28%) expect a short-term drop in sales of more than 50%, but are optimistic in the longer term because in the outlook to the end of the year, only 13% of entrepreneurs expect a drop in sales of more than half. On a scale according to company size, small companies with turnover of up to CZK 50 million expect their sales to fall by up to 40%, while the directors of the largest companies with turnover in excess of CZK 3 billion are more optimistic and expect a one-fifth drop – this tells us smaller companies are expecting relatively more noticeable economic impacts than larger players.

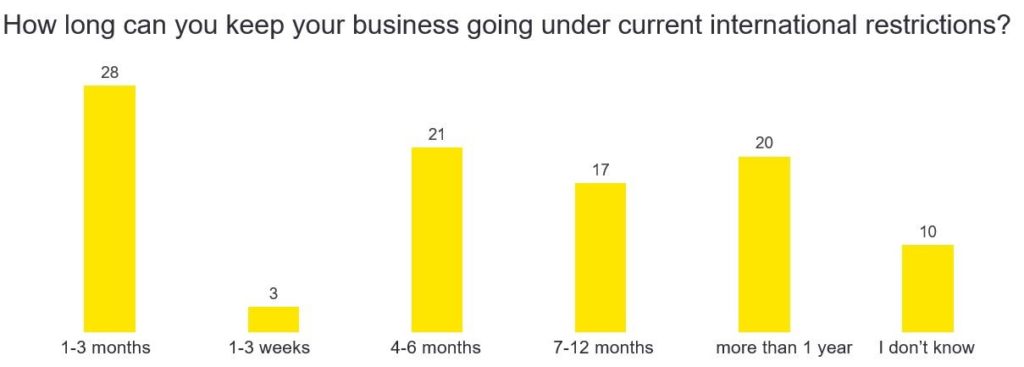

“We see that the most affected entrepreneurs, i.e. those who expect a drop in sales of more than 50%, will survive without additional financial assistance on average a maximum of half a year. On the other hand, 55% of the most vulnerable companies will need to use financing within 3 months,” says Magdalena Souček, EY Country Managing Partner in the Czech Republic and for the Central and Eastern Europe Region.

“During the period of economic growth, 57% of entrepreneurs prepared financial reserves for more than 2 months of loss of income, while 40% of companies will not be able to finance the current situation for more than 2 months. More than 60% of companies will need to increase funding, through their current bank, a COVID program or another extraordinary bridging resource. We see that two-thirds of these companies are already negotiating with their bank, and more than one-third are considering requesting a deferral of payments under the credit moratorium,” says David Zlámal, EY Transaction Advisory Services Partner.

In terms of the sectoral strength of the impact, companies in the manufacturing, wholesale and retail trade, in the field of motor vehicle repair and maintenance, accommodation, catering and hospitality are the most affected.

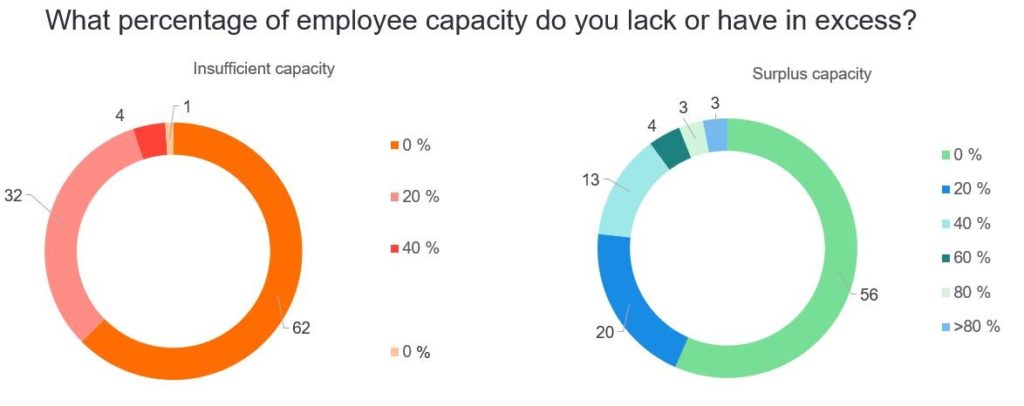

The impact of the crisis expected by entrepreneurs on individual Czech regions varies greatly. While 14% of entrepreneurs describe having an employee surplus, 8% on average indicate staffing insufficiencies.

Some 43% of companies have an excess of work capacity, especially in the fields of manufacturing, wholesale and retail trade and accommodation, catering and hospitality. These are mainly companies in the Capital City of Prague, the South Moravian, Moravian-Silesian, Olomouc and Zlín regions.

On the other hand, 36% of companies face a shortage of employees, despite the current restrictions, while a third of these employees could, in the opinion of entrepreneurs, be replaced by workers from other fields. The surveyed companies require labour mainly in the manufacturing sector or wholesale and retail. The demand is most pressing in the Moravian-Silesian Region, the Capital City of Prague, the Pardubice Region, the Central Bohemian Region and the Zlín Region.

“Key measures entrepreneurs will need to implement over the next 3 months incorporate two main themes – ensuring the health and running of the company, namely mutual support or better communication, and reducing staff costs, either by reducing wages, shortening the working week, support through short-time work or by waiving compulsory levies,” says Vladislav Severa, EY’s Managing Partner for Advanced Analytics.

Some 39% of companies are using work from home, but 72% of them feel it offers a lesser degree of work efficiency. In order to be able to make better use of telework, they would welcome improved connectivity, the introduction of eGovernment and higher employee morale.

Three quarters of companies (77%) perceive short-time work (Kurzarbeit) as a suitable solution to the current situation, but the option proposed by the State, i.e. 20% of work and 80% at home paid by the State, is only feasible for 8% of companies. Other companies propose a higher employment rate, ideally corresponding to 60% of the working time. Eight of 10 entrepreneurs perceive social insurance, and 68% of entrepreneurs health insurance, as the biggest tax burden under the current circumstances. This corresponds to perceived assistance in the form of deferred tax obligations. According to 37% of entrepreneurs, the ideal form would be to postpone the maturity of social and health insurance by 4 to 6 months.

The opening of borders to neighbouring countries, mainly Slovakia and Germany, and the countries of the European Union would help companies the most. Almost half of companies (47%) are experiencing problems with the cross-border movement of people. The biggest obstacles for 47% of companies are the import of materials, exports of products and missing customers. Two-thirds of companies are facing a slowdown in supply, one-third are suffering from supply disruptions and/or cost increases..

Some 70% of entrepreneurs agree it is not possible to keep a business going for more than 12 months under current international restrictions. Almost half of entrepreneurs (47%) are calling for the opening of borders at least with neighbouring countries in order to maintain their business. From the point of view of geopolitical orientation, for 58% of entrepreneurs the opening of borders with EU countries is important, for 16% with Russia and the post-Soviet countries.

While 42% of companies estimate a return to normal within half a year, 30% expect a return in a period of more than one year. Despite the difficult period that the economy is currently going through, many entrepreneurs see certain positives arising from the current situation. They are aware of the importance of personal and entrepreneurial values. They see opportunities for accelerating the digitization of work and education or processes in the public sphere, and they mention the need for more thorough and robust IT infrastructure security. They expect necessary improvement in the labour market situation, especially a broader choice of better colleagues, more realistic salaries or even greater employee loyalty. The survey also addressed the issue of Europe's self-sufficiency and dependence on China.