Two thirds of executives of 100 banks operating in Central and Eastern Europe think that the economic situation in the banking market in 2012 worsened. The only country where positive or neutral rating of last year prevails is the Czech Republic. Czech bankers are also the only ones who plan future investments, while banks in other countries prefer further cost reductions. In 2013, however, bankers in the region expect a slight improvement.

Such is the general conclusion of KPMG Czech Republic’s Banking Executive Survey 2012 which reports on the opinions of top management of banks from the Czech Republic, Austria, Slovakia, Hungary, Poland and Romania. "The situation in each country is quite different, but in general the markets where these banks are operating have steadied," says Zdeněk Tůma, Head of Banking at KPMG in the Czech Republic.

The main findings of the survey are the following:

- Assessment of the overall economic situation in the banking sectors is generally not so optimistic for the current period, but is slightly improving for next year.

- Expected revenues are lower for 2012 and do not seem to improve much in 2013; the same goes for profitability, where banks obviously already exploited benefits of their cost-cutting measures.

- Financial market leaders clearly indicate that the economic recovery is dependent chiefly on boosting confidence in the market (on the part of investors, consumers and other companies).

- There have been changes in the banks’ approach to risk management as most of them improved methodologies and increased management focus.

- Ability to raise capital seems to have increased a bit while ability to obtain financing decreased.

- In their future strategic plans, banks are leaning more towards cost-cutting than to investment aimed at long-term growth. The areas for savings were mainly in marketing spending and employee headcounts. If banks invest, it is mainly in risk management, compliance with regulations, employee development and ICT solutions.

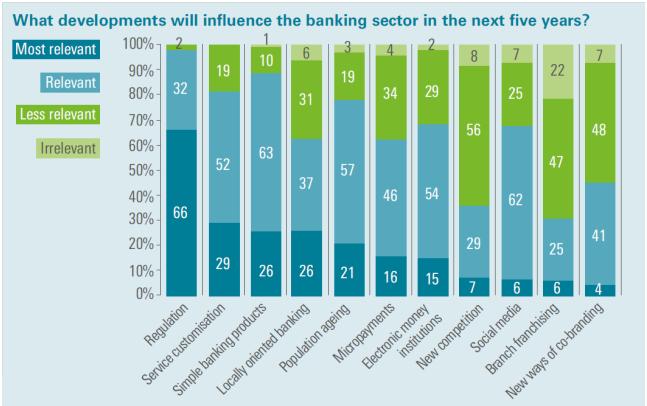

- The next five years will be influenced the most by increased regulation, new simple banking products and product optimisation

About the survey:

KPMG’s Banking Executive Survey was first conducted among Czech and Slovak banks in 2010. In 2012 the scope was broadened and the sector’s leading banks from Austria, Hungary, Poland and Romania were also surveyed. In cooperation with the top management of more than 100 respondent banks, their current state, the situation in which they found themselves in the same period of the previous year, and the outlook for the future, including measures that need to be taken to increase financial performance, were mapped. KPMG’s Banking Executive Survey 2012 can be downloaded from http://www.kpmg.com/CZ/en/industry/Banking/Pages/default.aspx.